For a long time, I’ve wanted to write a post about creating your own strategy using just one tool. Well, the time has come to introduce the Master Oscillators Trading Bot.

But what exactly is the Master Oscillators?

Is it just another trading bot promising to make you rich like so many other Expert Advisors you might have been scammed by? Is it an AI bot that has supposedly cracked the secrets of the market, guaranteeing wealth while you sit back and do nothing?

Let’s be real here, mister (or miss) trader—if your goal is to get rich without lifting a finger (what they often call “passive income,” as far as I know), you’ll need to look elsewhere. I genuinely hope you succeed. If that doesn’t work out, feel free to come back here, and maybe we can help you start creating your success on your own terms. Not by relying on unknown strategies or magical filters, but by truly understanding how the market works—with its good and bad days. Get your hands dirty, and let’s start crafting some real strategies together.

The Master Oscillators gives you a wide range of options to build your own strategy. It uses signals from some of the most popular oscillators—RSI, CCI, and Stochastic—which can help you identify market order flow as well as overbought and oversold levels. With these tools, you can create either mean reversion or trend-following strategies. To enhance your precision, we’ve also included some of the most effective filters, such as MA, MACD, and ADX.

You can choose between dynamic or fixed lot size calculations, multiple ways to determine stop-loss and take-profit levels, daily and overall account protection, and so much more that I simply can’t cover it all in one post.

Let’s start building! 🚀

Some hard-rules first

Step 1: Identify Your Asset and Timeframe

Choosing the right asset and timeframe is critical. Determine whether you’re targeting forex, commodities, indices, or crypto. Then, assess the market’s behavior on your chosen timeframe: Is it trending or consolidating? Running demo strategies can provide valuable insights into how the market acts and guide your decision.

Step 2: Set Daily and General Stop Loss Limits

Protect your capital by configuring your stop loss settings in the Manage tab. Establish clear boundaries to prevent excessive losses.

💡 Pro Tip: To ensure uninterrupted performance, consider running the Master Oscillators bot on a VPS, which allows 24/7 operation.

Step 3: Choose Your Main Signal Source and Filters

Decide which oscillator to use as your primary signal source—RSI, CCI, or Stochastic. Each has unique strengths, so consider their characteristics carefully.

Complement your signal source with filters to refine entries and exits for optimal performance.

Step 4: Determine the Maximum Open Positions

Set the maximum number of simultaneous positions you’re comfortable with. This keeps your risk under control and aligns your trading approach with your goals.

Step 5: Configure Opposite Signal Closures

Decide if you want the bot to automatically close all opposite positions when a new signal appears. This can streamline your trading and keep your strategy aligned with the latest signals.

Step 6: Define Your Trading Time Window

Select the specific time window for trading activity. If you prefer a daily approach, configure the bot to close all positions at the end of the trading day, ensuring no overnight exposure.

Step 7: Backtest Your Strategy

Use the MT5 Strategy Tester to test and refine your strategy. Pay close attention to weak points, such as significant drawdowns. Ask yourself: Why did this happen, and how can I mitigate it? Consider factors like market news or high-impact events that could affect performance.

Step 8: Start with a Demo Account

Deploy your strategy on a demo account to observe its performance under live market conditions. Monitor results closely and make adjustments as needed to address potential weak points.

Let’s Create a Strategy Together

Now, let’s build a strategy step by step. We’ll keep it simple and straightforward.

Entry Rules

The entry rule will be based on the CCI Indicator:

- When the CCI crosses below a specific level (indicating the price is moving downwards), we’ll execute a buy position.

- When it crosses above another level, we’ll trigger a sell position.

Since I personally love mean-reversion strategies, I’ll use the MA filter. This filter represents the “mean” we aim for the price to revert to. With this approach:

- We’ll allow sell positions only if the price is above the MA.

- We’ll allow buy positions only if the price is below the MA.

For simplicity, I’ll use a 50-period SMA (Simple Moving Average) as the filter. This should give us a good starting point to evaluate the strategy.

For the CCI levels, I’ll stick to the default values (100 for overbought and -100 for oversold).

Another key adjustment: I’ll only allow entries if the price is a minimum distance away from the MA. There’s no point in entering positions when the current price is very close to our target (the MA). I’ll set this minimum distance to 200 points.

Symbol and Timeframe

The hardest decision, as always, is selecting the symbol and timeframe. I’ll start with EURUSD on the H1 timeframe. EURUSD is a stable choice for mean-reversion strategies, with typically low spreads across most brokers. Of course, we’ll need to be cautious during high-impact news events, which can disrupt these patterns.

Dynamic Exit Rule

For this strategy, I’ll use the MA as a dynamic exit point. I’ll enable the “Close Positions if Price Crosses MA” option to ensure all trades aim for the mean.

Stop Loss and Take Profit

I’ll set the Stop Loss and Take Profit levels far away from the entry price intentionally. This helps me observe the potential drawdowns during backtesting and better understand the strategy’s behavior. Remember, in live trading, I would set daily and general stop limits in the Manage tab to protect the account.

Lot Size and Trading Hours

The lot size will be fixed at the minimum allowed for EURUSD (0.01).

For trading hours, I’ll configure the bot to trade between 1 AM and 11 PM (broker’s time), avoiding the large spreads that typically occur outside this window. However, I won’t force the bot to close all positions at the end of the day—open trades can continue as long as the strategy logic allows.

Time to Test

I think we’re ready to give this strategy a shot. Let’s see how it performs throughout 2024. Time to backtest and observe the results!

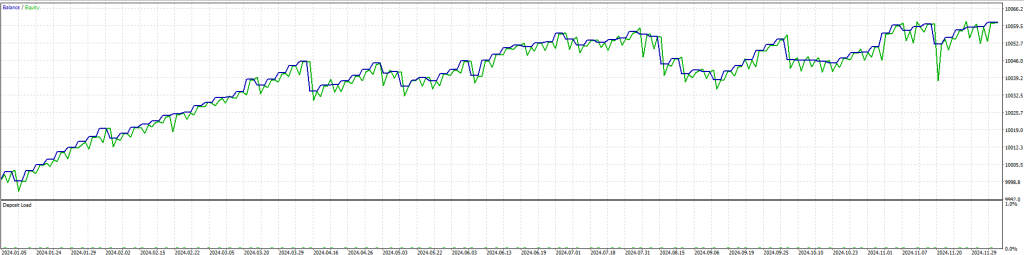

Graph:

Staying on Point: The Goal is an Upward Graph 📈

At the end of the day, the most important goal is simple: a graph that points upwards! Consistent growth over time is what we’re aiming for, and now it’s time to dive into some statistics to see how our strategy performs.

Let’s explore the data together and uncover the insights that can help refine and improve this approach.

Wrapping Up: The Power of Statistics and Your Path to Success

A good profit factor, an excellent Sharpe ratio, and plenty of other great statistics—these are the benchmarks we’ll analyze as we work to make our strategy even more powerful. Remember, in this example, we used default values and kept things simple. Also, the lot size was set to the minimum allowed. While higher lot sizes can lead to higher profits (along with higher risks), that’s not our focus here. We’ll likely explore that in another post.

What I want to emphasize in this post is something I’ve learned from experience: success in trading (and in life) has to come from you. No one is going to hand you the money for a comfortable life, and no one is going to gift you a strategy that makes you rich overnight. That’s exactly why we provide tools like the Master Oscillators—to empower you to create your own success. Sometimes, we also give you a gentle push in the direction we believe will help you forge your own path.

I hope you enjoyed this introduction to the Master Oscillators Trading Bot. Don’t forget to follow us on social media (@xignalcoding) to stay updated with all the latest news and developments.

Until next time,

Ioannis Xenos

xignalcoding.com