A few months ago, just before my wedding, I decided to take on the Funded Next challenge using the Master Oscillators. My goal was to pass the challenge quickly, so I opted for a high lot size strategy. Let’s be honest, we all want to be able and pass a prop firm challenge within 3 days, but it is always very risky. After all, the daily and overall account protection features in the Manage tab were there to safeguard me if anything went wrong. Since there were no major events affecting USD and EUR during that period, I felt confident in proceeding with a mean reversion strategy.

Unfortunately, the challenge and verification accounts are now inactive, so I can’t connect them to MyFxBook to share detailed results. Instead, I’ll rely on screenshots. My goal here isn’t to showcase trading skills but to demonstrate the versatility of the Master Oscillators and how it can support different trading approaches.

The Strategy

The idea was simple yet effective. I focused on a mean reversion strategy on the M5 timeframe, entering positions when the CCI indicated a reversal—coming back from overbought or oversold levels. The target? The moving average. I’ve always believed the moving average serves as an excellent dynamic target, whether as a take-profit level or a stop-loss level in other strategies.

Back then, we didn’t have the MA distance feature that’s available now, which allows trades to open only when the price is significantly far from the moving average. This made the strategy even more manual, but the results were worth it.

The Results

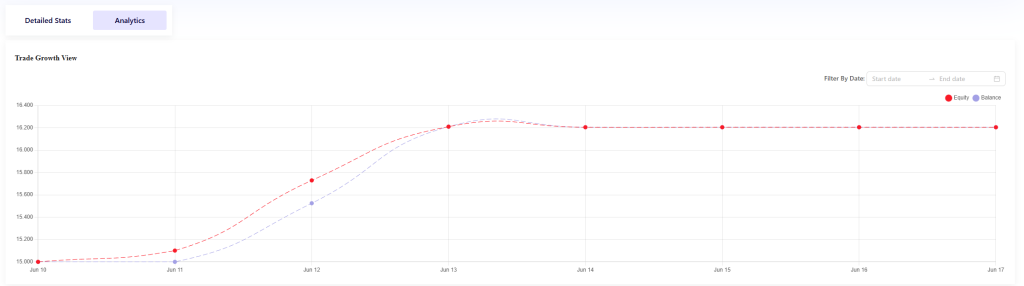

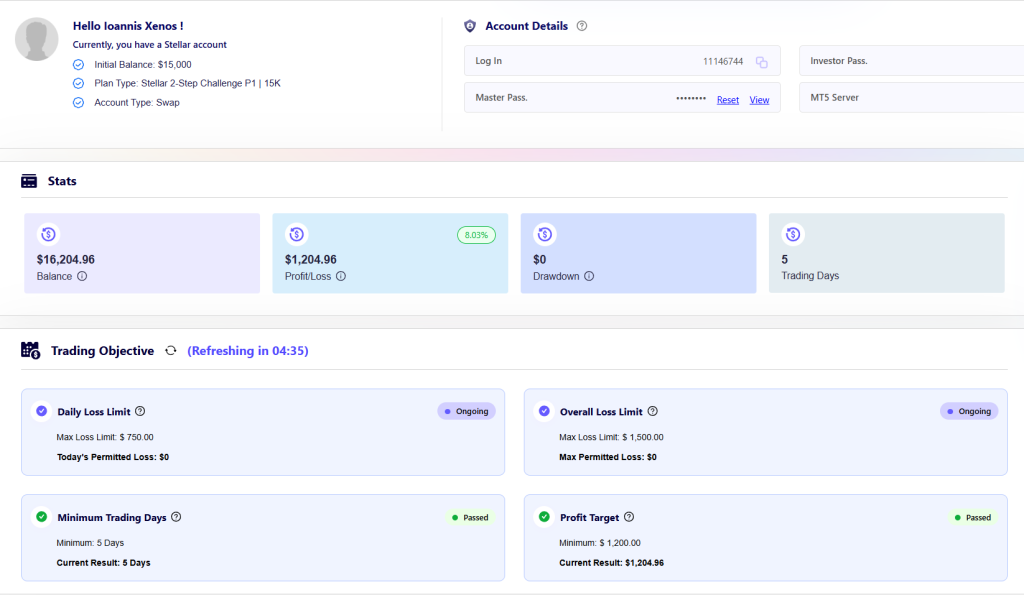

The results were incredible! I managed to pass the $15K challenge within three days. For the remaining two days, I traded with a very low lot size to meet the minimum five-day trading requirement.

Here’s the equity curve:

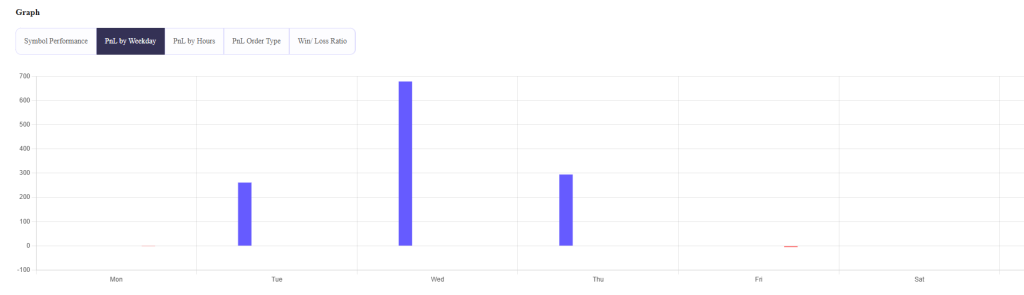

Daily profits looked like this:

The second day was especially significant, with returns of around 5%, making the rest of the process much easier.

Here’s an overview of the account:

But How Did I Do It?

Here’s the thing: it’s not just about copying what I did. I understand the appeal of having everything set up and simply waiting for profits, but that’s not the goal here. My mission is to empower you to create your own strategies.

When you develop your own strategies, you gain a deeper understanding of the markets you trade. You learn their strengths and weaknesses, and, ultimately, you become a better trader. In contrast, blindly following a single strategy leaves you in the dark. You won’t know why you’re gaining or losing, and you’ll often end up blaming the creator for unmet expectations.

That’s why I always provide a set file with any Xignal Coding program purchase. It’s a great starting point, but the real value lies in tailoring strategies to your own style.

Final Thoughts

Don’t be afraid to experiment with new ideas and strategies on demo accounts. Master Oscillators is packed with tools to support your trading journey and will protect you if a strategy doesn’t work out. And here’s some exciting news: Version 3 is coming soon, with even more features to enhance your trading experience!

As for what happened after passing the challenge and verification… stay tuned! I’ll share how we got banned (!) from Funded Next and why I don’t recommend this company. Of course, the decision of where to trade is always yours to make.

Ioannis Xenos

You can check the xignalcoding products here: https://xignalcoding.com/marketplace/

You can purchase from the MQL marketplace: https://www.mql5.com/en/market/product/101500