What’s new in Master Oscillators 3.0?

After carefully listening to your feedback and understanding your needs, we’ve made significant updates to ensure the Master Oscillators remains the ultimate trading bot for fully automating your strategies. With ten new functionalities, your trading journey becomes even more enjoyable. Our goal is to make trading feel like a game, no matter your trading style. Let’s dive into what’s new and how you can benefit from these updates!

1. MACD Filter

The MACD indicator is a powerful and widely-used tool, suitable for both mean reversion and trend-following strategies. You can customize its inputs and timeframe, then simply choose whether you’d like the MACD line to be above or below the signal line to allow buy or sell positions to be placed.

2. Equity Target

Many of you trade with prop firms, where challenges often have profit targets (typically 10% or 5% during verification). Now, you can set an equity target so the Master Oscillators will close all open positions and stop trading once the target is achieved. This helps you avoid unnecessary risks and prevents potential drawdowns after hitting your goal.

3. Exit Profits for Each Direction

Some strategies require separate approaches for buy and sell positions. For example, building buy positions during a strong uptrend while managing sells differently. Now, you can close all open positions in one direction after reaching a specific profit, while the opposite direction remains active.

4. Close All Button

By popular demand, the “Close All” button is now front and center on the first tab. This allows you to close all trades instantly—for any reason (e.g., news releases or strategy changes). Managing trades has never been easier!

5. MA Target Displayed on the Chart

For strategies using the moving average (MA) as the profit target, we’ve added a visual cue. A gray line now shows the MA’s position directly on the chart, even if the MA’s timeframe differs from the one generating entry signals. No more switching between charts to see your target!

6. Entry Conditions Based on Average Price and MA

To minimize risk, you can now restrict entries to only occur when the average entry price is better than the MA target. This ensures your trades are positioned to secure profits when the price meets the MA.

7. Grid-Like Entry with Oscillator Confirmation

A new grid-like functionality allows entries only when the price is above or below the last entry price by a set number of points, with oscillator confirmation. This minimizes unnecessary positions and increases profitability when the target is reached.

8. Break-Even Functionality

You asked, we delivered! The break-even feature allows you to adjust stop-loss (SL) to the entry price after a set number of points or an ATR multiplier, locking in profits when conditions are met.

9. Trailing Stop Loss with ATR

In addition to the points-based trailing stop-loss, you can now use an ATR multiplier to dynamically adjust your SL, providing greater flexibility.

10. Maximum Unprotected Buy/Sell Positions

Limit the number of open positions that are not yet secured with profits from the break even or the trailing stoploss functionality. This feature is especially useful in trending strategies, where you can safely build more positions in your favor while keeping unprotected positions to a minimum.

Comparison with the Old Version

The new features allow you to create thousands of new set files, making a simple 1v1 comparison quite challenging. However, to demonstrate the differences, we’ll compare the set file we provide to all Master Oscillators users with just one new feature enabled: the Break-Even (BE) functionality.

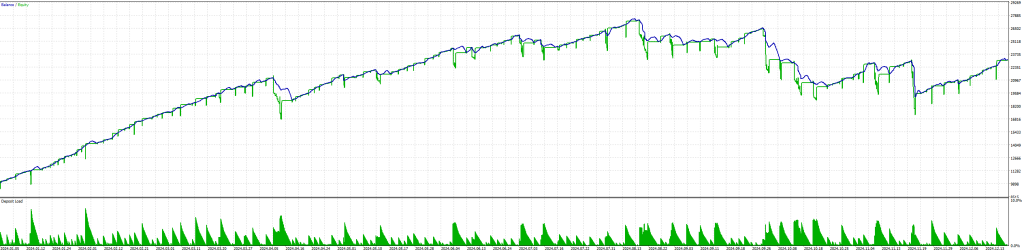

Performance of the Previous Version

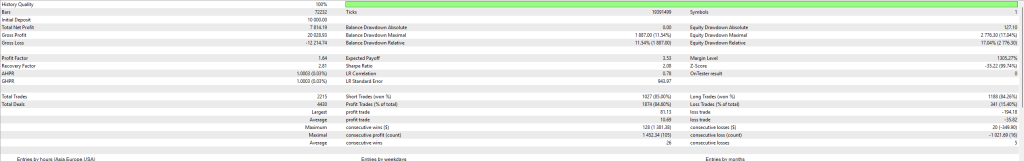

First, let’s look at last year’s performance using the set file that you all have.

Here’s the graph:

Backtest Results:

Key Points:

- Lot size: 0.1 per trade

- Profit Factor: 1.43

- Sharpe Ratio: 1.88

- Drawdown: 36.72%

- Total Return: 131% in one year

The results were solid! If we exclude the unstable period of the US elections—which caused several drawdowns in the strategy (I know many of you paused trading during this period, but backtesting should reflect both good and bad conditions)—you would have seen even better performance.

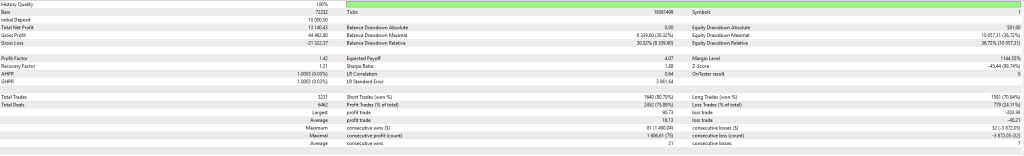

Performance with Break-Even Functionality Enabled

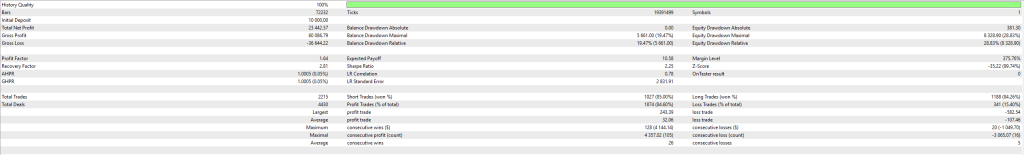

Now, let’s enable the Break-Even (BE) functionality.

The BE is triggered at 100 points of profit, and it moves the SL line to entry + 50 points, ensuring some profits are secured. Note: These numbers are not optimized. With further optimization, you could find even better BE settings.

Here’s the updated graph:

Backtest Results:

Key Points:

- Profit Factor: Increased to 1.64

- Sharpe Ratio: Increased to 2.08

- Drawdown: Reduced to 17.04%

By simply enabling the Break-Even functionality, we’ve already improved the strategy significantly!

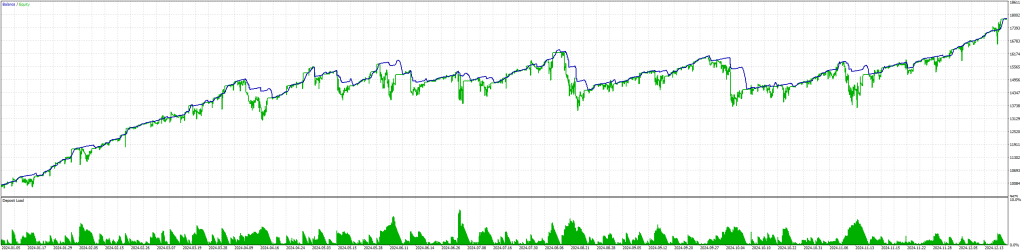

Maximizing Performance with the Same Risk

To make a fair comparison, I prefer to target the same drawdown (DD) and see if we can achieve higher profits. So, I increased the lot size to 0.3 (three times larger).

The graph remains the same, so let’s jump straight to the backtesting results.

Backtest Results with Increased Lot Size:

Key Points:

- Profit: 234% in one year!

- Drawdown: Still lower at 28.83%

All this was achieved while trading during high-volatility periods, such as the US elections.

Conclusion

The third version of Master Oscillators has not only introduced new features but also enhanced its performance potential. With just the Break-Even functionality enabled, we’ve demonstrated how you can improve profitability, reduce risk, and optimize your strategy further. Imagine the possibilities when combining all the new features!

I’ll see you in the next post, where we’ll explore even more exciting developments in trading together. Until then, I wish you a Happy New Year and all the success in your trading journey!

Ioannis Xenos – Founder of xignalcoding.com