📘 User Guide for XignalCoding Prop Grid EA – Input Settings

Welcome to the XignalCoding Prop Grid Expert Advisor. Below is a detailed explanation of each input setting to help you configure and optimize the bot for your trading style and risk management.

🔹 Entry Signal Options

Select the method used to trigger entries:

Williams %R

Stochastic

RSI (Relative Strength Index)

CCI (Commodity Channel Index)

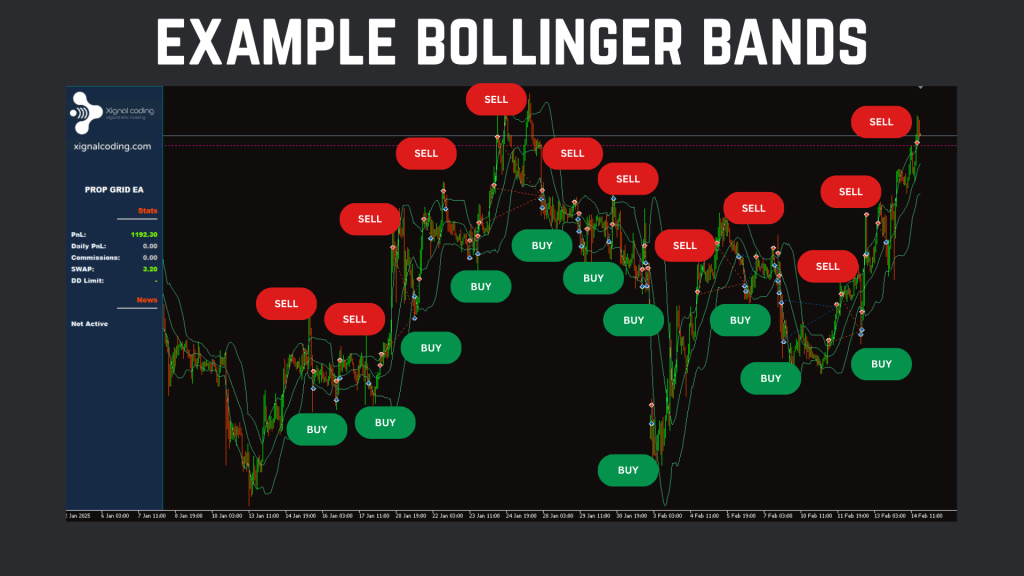

Bollinger Bands

Breakout

Percentage Pullback Entry

Linear Regression

Note: Linear Regression works only in visual mode when backtesting.

🔹 General Inputs

Lot Calculation Method

Choose between:Fixed: Constant lot size.

Dynamic: Lot size adjusts based on balance (e.g., 0.1 lot per 10,000 account balance).

Lot Size

Used either as the fixed lot or as the base unit for dynamic calculation.

Use Grid

Enable/Disable grid trading mode.

Max Trades of Grid

Max number of grid entries allowed per direction (buy/sell).

Grid Distance (Points or ATR)

Distance between each grid position. You can use a fixed number of points or enable dynamic distance using ATR.

Signal Shift

Determines when to open the initial trade:

0: At signal bar open1: After signal bar closes

Stop Grid if More Levels Required

If the number of grid trades exceeds your limit, all open positions of that direction are closed to protect capital.

Apply Grid Trades on New Bar

Grid trades will be opened:

Immediately when grid distance is reached, or

Only after a new bar confirms the condition.

New Bar Timeframe

The timeframe used to detect the closing of the new bar before opening grid positions.

Profit Exit for Grid

Choose the method for exiting the grid:Simple: Each trade targets a fixed profit.

Dynamic: Total target = profit per trade × number of trades.

Paragontic: Smart exit calculation aiming to balance total profit vs. risk.

Grid Target Profit

Profit target in points for each trade (used in Simple or Dynamic modes).

Take Profit (Points or ATR)

Take Profit level for the initial entry only (grid trades do not copy TP).

Stop Loss (Points or ATR)

SL applies only to the first trade. If Grid mode is enabled, SL is ignored for grid trades.

🔹 Other Settings

Expert Magic Number

Unique identifier for the EA. Change this if running the bot on multiple charts/symbols.

Deviation

Acceptable slippage in points when sending trade orders.

🔹 Oscillator-Based Entry Settings

These inputs are active only if an oscillator-based signal is selected.

Oscillator Level for Buy / Sell

Set the threshold level to trigger buy/sell (e.g., 30 or 70).

Oscillator Cross Type for Buy / Sell

Define direction of level crossing:

Above Level

Below Level

🔹 Oscillator Settings

Williams / RSI / CCI Period

The lookback period for these indicators.

Stochastic K% Period

Stochastic D% Period

Stochastic Slowing

Classic stochastic configuration values.

🔹 Bollinger Bands Settings

Used only if Bollinger Bands are selected as the entry signal.

Crossing Band for Buy / Sell

Choose whether the price must cross the upper or lower band.

Bollinger Bands Period

Bollinger Bands Deviations

Standard deviation setting for band calculation.

🔹 Breakout Settings

Breakout Lookback Bars

Number of bars to check for high/low breakout reference.

Buy Breakout at

Choose: Break above High or Low.

Sell Breakout at

Choose: Break below High or Low.

🔹 Fibonacci Pullback Settings

Entry Percentage of the Pullback

Pullback level (from 0.0 to 1.0) to trigger an opposite direction entry.

Fibonacci Lookback Period

Number of bars to define the high/low range for calculating the retracement.

🔹 Filter and Protection Settings

These settings add powerful layers of control and risk management to your strategy. Use them to filter false signals, align with market trends, avoid trading during news events, and control drawdowns.

✅ MACD Filter

Enable to allow trades only when MACD conditions are met.

Use MACD Filter: Enables or disables the filter.

MACD Timeframe: Timeframe used for MACD calculation.

MACD EMA (Fast EMA): Short-term exponential moving average period.

MACD Slow EMA: Long-term exponential moving average period.

MACD SMA: Signal line period.

MACD Crossing Type for Buy: Choose if buy is allowed when the MACD crosses above or below.

MACD Crossing Level for Buy: Threshold level required for a buy.

MACD Crossing Type for Sell: Same as above, but for sell signals.

MACD Crossing Level for Sell: Threshold level required for a sell.

✅ ADX Filter

Use the Average Directional Index to allow trades only when the market shows clear strength.

Use ADX Filter: Enables or disables the filter.

ADX Period: Number of bars used to calculate ADX.

ADX Above or Below Level: Determines if ADX must be above or below the selected level.

ADX Level: Minimum or maximum strength required.

ADX Timeframe: Timeframe for ADX filter.

✅ Trading Window

Define your preferred trading hours using your broker’s server time.

Starting Time (Broker’s Time): When the bot is allowed to start trading.

Ending Time (Broker’s Time): When trading should stop.

Close All Positions at Ending Time: If enabled, all open trades will be closed when the ending time is reached.

✅ News Filter

Avoid trading during major economic events to reduce unexpected volatility.

Use News Filter: Enables/disables the news filter.

Currencies: Specify which currency-related news should be considered (e.g., USD, EUR).

Stop Trading For:

Minutes before news to stop trading: Pauses trading ahead of the event.

Minutes after news to start trading: Delays resumption of trading after the event.

- All day

✅ Drawdown Protection

Protect your account from large losses by limiting daily risk.

Use Daily Drawdown Percentage Protection: Activates this feature.

Daily Drawdown %: The max percentage of equity loss allowed in a single day. If exceeded, the bot stops trading for the rest of the day.

Use General Emergency Exit: Enables an emergency stop-loss for extreme scenarios.

General Emergency Exit in %: If equity falls by this percentage during the session, all trades will be closed and trading halted.

✅ ATR for Dynamic Distance Calculation

Use Average True Range to calculate dynamic distances for grid and SL/TP.

Use ATR: Enables ATR-based distance instead of fixed point values.

ATR Period: Number of candles used in ATR calculation.

ATR Timeframe: Timeframe used for ATR.